|

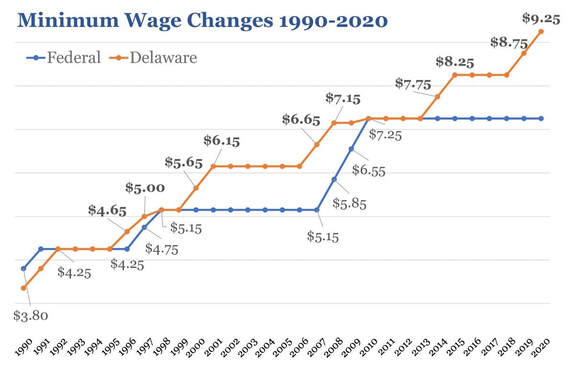

By James DeChene, Armitage DeChene & Associates This week the Delaware Senate passed SB15, which increases Delaware’s minimum wage starting in 2022. As previously reported, the increases are as follows:

The bill now goes to the House to be assigned to committee. More to come on that. The updated version of HB150, a bill that would legalize marijuana was introduced this week. We will be reviewing the bill for any changes from prior versions and update you. In the meantime, if you have not yet registered for next week’s Manufacturing & Policy Conference, a reminder that there will be a marijuana roundtable to explore the impacts on employers. We also expect to hold another in-depth seminar on the issue soon. More info to come. Also this week, the Delaware Economic and Financial Advisory Council (DEFAC) met and revised upwards revenues for FY2021 and FY2022 for a total of $322 million. The revision is largely due to strong performance in Personal Income Tax (PIT), Corporate Income Tax (CIT), and the Franchise Tax. In fact, year over year incorporation numbers rose from 12,000 to 15,000 new entities formed. The gains in PIT should largely negate argument this year on HB64, which would create new PIT levels for high earners. Lastly, with the passage of the American Rescue Plan, Delaware should see another $1.4 billion to help with coronavirus relief efforts. Cities and towns are also expected to receive significant monies that can be allocated towards lost revenues along with water, sewer and broadband improvement projects.

0 Comments

By James DeChene, Armitage DeChene & Associates

The Delaware State Chamber of Commerce respectfully offered a number of policies to the 151st General Assembly that, if enacted, would assist the business community in rebounding from the impact of the COVID-19 pandemic, while at the same time help Delaware workers find new opportunities. TAX CREDIT FOR RAPID WORKFORCE TRAINING & REDEPLOYMENT INITIATIVE HIRES This past summer, Governor Carney issued Executive Order #43, which established the Rapid Workforce Training and Redeployment Initiative, a time compressed curriculum to be focused on in-demand industry sectors and/or occupations. The program will make available certificate programs, certification programs and access to the Today’s Reinvestment Around Industry Needs (“TRAIN”) program to help prepare Delaware workers who may have been displaced by the impact of COVID-19 find a new career path. The State Chamber recommends a refundable tax credit be made available to employers who hire graduates from these programs much the same as the credit for hiring veterans and those with disabilities. ENGAGE IN CREATING PROCESS-RELATED EFFICIENCES IN OVERSIGHT AGENCIES In recent years the State Chamber has focused on the process log jams that serve as impediments to development in Delaware. By working with agencies like DelDOT, the Chamber worked to streamline plan review process, resulting in simple project submission documents for a number of common projects, like curb cut-outs and driveway access. The Chamber has commitments from DelDOT to continue to find ways to streamline these processes, and now will be working with DNREC to do the same. These partnerships serve to find innovative solutions to issues without sacrificing public input and holding accountable applicants with incomplete application submissions. FOCUS ON CHILDCARE It is estimated nationally 30% of childcare facilities will not reopen due to the COVID-19 pandemic. The impact to employers and employees will be felt across all sectors and become a challenge for all to overcome. Access to childcare in increasing in importance as businesses continue to reopen and expand operating capacity. While not a crisis in Delaware yet, the State Chamber urgers a proactive response by the General Assembly to prepare for this eventuality. In addition, the State Chamber will be working with our Federal delegation to make much needed changes the CARES Act. A top priority change would be to extend the deadline for spending appropriated funds. Many programs Delaware directed CARES dollars towards, including expanding rural broadband, are a long-term investment due to construction needs, etc. While the State can appropriate these dollars, it is next to impossible to actually spend the money prior to the current deadline. Other priorities include an expansion of COVID-19 testing to help ensure businesses remain open, which in turn helps state finances and negates a need for tax increases next year. 2021 is bound to be a period of flux and transition. With the impacts of the COVID-19 pandemic still being felt, the possibility of a vaccine being developed and distributed, along with a new President, Congress, Administration, and our own General Assembly, the business community should prepare itself to be more nimble than ever with change happening at lightning speed. By James DeChene, Armitage DeChene & Associates

The General Assembly gaveled out of session early on July 1, 2020 in what was the earliest ending in recent memory due to what has been an almost indescribable year to date. With little to no drama on the money bills (Budget, Grants in Aid, and Bond) as they were passed on June 29th, the General Assembly was left to close out a few bills on consent agendas. The Senate said goodbye to retiring Senator Harris McDowell, and the House bid farewell to retiring Representative Quinn Johnson. This means that for next session there will be two new co-chairs for the Joint Finance Committee and both the Senate and House Energy Committees will have new chairs as well. As the General Assembly came back to session in January, members seemed poised to pass a series of legislation that included increasing Delaware’s minimum wage, expanding worker’s rights, and increasing the role and presence of private and public employee unions. Those bills largely went nowhere, and with the COVID-19 pandemic altering how the legislature would work, those bills were placed on hold until next year. The same can be said for legislation the business community supported as well. Efforts to invest in clean water infrastructure, building a new high school in the City of Wilmington, modifying the state’s offerings of Association Health Plans and creating new workforce training platforms (more on that later) all took a pause as well. That said, a number of bills important to the business community were introduced, and some were acted on in the final weeks of this session. They included:

In the midst of three months of uncertainty, countless Zoom meetings with Governor Carney, members and staff from his Administration, the chambers of commerce community, stakeholder groups and others, there were a number of positives that were announced, and work completed ahead of schedule. The State Chamber has long been an advocate for rural broadband development and adoption. Last year’s announcement of BlooSurf, a project to bring broadband to western Sussex and Kent counties was met with fierce approval. Originally slated to be completed in 18-24 months, the project was able to be completed in just over 12 by using federal CARES Act funds to speed up the building process. In July 2020, 15 towers are set to be completed. Efforts to promote residential adoption of broadband will roll out soon after in preparation for what could be another school year of distance learning. Now children in these communities will be able to be active participants. Similar broadband adoption efforts are taking place in Wilmington with the similar goal of making sure all children have access to distance learning efforts. For the last year, the State Chamber has pushed for the creation of a workforce training program similar to what has worked with ZipCode Wilmington. A compressed, 40-hour week training schedule focusing on in-demand career paths that will help transition low-skill workers into better paying jobs. While the legislation creating this program was not worked on this year, we continue to work with Governor Carney and his Administration on creative ways to implement such a program, especially in light of the potential permanent job losses related to COVID-19. WHAT'S NEXT? Between now and January 2021, when the 151st General Assembly convenes, much will have happened:

There remains a great deal of uncertainty as we enter the second half of 2020. What does remain certain, however, is the Delaware State Chamber of Commerce’s dedication to advocacy on behalf of its members – the business community. Look for more opportunities in the coming months to hear from experts on the latest trends as the COVID-19 pandemic, and recovery, continue to evolve. Also look for innovative networking opportunities and other creative ways to get your business noticed. For more information, check www.DSCC.com. by James DeChene This week the General Assembly returned from Easter break and the State Chamber, in partnership with its Small Business Committee and the Association of Chambers, hosted the 5th Annual Small Business Day in Dover. Over 70 people, including Chamber representatives, businesses leaders and elected officials, attended the event. The agenda included meetings between business owners and their legislators, and participation in the Small Business Caucus monthly meeting. Policy items of focus included HB80--Earned Income Tax Credit (Chamber supports), SB65—FAST Training (Chamber supports), HB15—New Personal Income Tax brackets (Chamber opposes), and the legalization of recreational marijuana (Chamber oppose). This week in Legislative Hall, HB130, related to single use plastic bags, was released from the House Natural Resources Committee. And SB74, with a technical correction to the New Economy Jobs tax credit (Chamber supports), left the Senate Banking and Business Committee.

Next week, SB21—Transportation Infrastructure Investment Fund (Chamber supports) is in committee. More to come as we learn more. Lastly, the Chamber is working to update its database to identify Chamber members that qualify as Diverse Suppliers. If you carry a Diverse Supplier designation please email Chuck James at [email protected]. Categories are Woman-Owned Business Enterprise, Minority-Owned Business Enterprise, Veteran-Owned Business Enterprise, Disabled-Owned Business Enterprise, Historically Black Colleges & Universities, LBGT-Owned Business Enterprise, Historically Underutilized Business (HUB), and Small Business Enterprise. by James DeChene

The General Assembly was out this week, and will be back on Tuesday. Last week I highlighted a number of bills having seen action so far this year, and below is the second half of that list. SS1 for SB37: Expungements This bill makes a number of misdemeanors eligible for mandatory expungement based on the passage of time with no subsequent offenses. The bill has also been amended to make more than two misdemeanors eligible for discretionary, rather than mandatory, expungement. The Chamber was involved in the process insofar as to make the case that employers have a right to know an applicant’s history balanced with the fact that an offender has paid their debt to society and should have the opportunity for gainful employment. The amendment makes the bill better, and has passed the Senate unanimously. It makes its way over to the House to be heard in committee. HB80: Earned Income Tax Credit (EITC) The Chamber supports this bill making the EITC a refundable credit in Delaware. This type of measure does more to support low income workers than minimum wage increases. A 2007 study by the University of New Hampshire found that seven out of 10 economists agree that the EITC is the best antipoverty program available to us, while only one out of 10 said the same thing about minimum wage hikes. The bill makes the EITC a refundable tax credit for Delaware state returns, an initiative the Chamber’s Tax Committee supports. HB130: Plastic Bags This bill expands upon the existing at-store recycling program regarding the use of single-use plastic bags. The existing requirements will continue, however stores subject to this program will now be limited from providing single-use plastic bags for only specific uses thereby encouraging a shift to reusable bags. The purpose of the bill, as detailed in the preamble, is to clean up Delaware’s communities and watersheds, reduce storm water and trash management costs to taxpayers, and promote the health and safety of watersheds, wildlife and humans, and the ecosystem’s food chain. On January 1, 2021 this bill enacts a ban on stores providing single-use plastic bags at check-out. Legalization of Recreational Marijuana While no bill currently has been introduced, the State Chamber of Commerce membership was polled and 71% of our members oppose the legalization of recreational marijuana. Consistent responses to the survey highlighted issues ranging from the availability of a drug free workforce, concerns about liability in the workplace (offices, manufacturing facilities, warehouses, construction sites, delivery drivers, etc.), the lack of a “spot test” to determine impairment, and on the potency of edibles and other delivery systems. All of these issues will be discussed in depth next Thursday at our Small Business Day in Dover event. Click here to register. More to come next week when the GA is back in session. Stay tuned. by James DeChene

This week marked the first of the General Assembly’s two-week Easter break. DEFAC met this week and revised its forecast by an additional $42.8 million for this year, and roughly $16 million for FY20. Each of DEFAC’s meetings this year have seen revisions upwards. A reminder that the Governor has urged the General Assembly to set aside any such increases to be used for savings for future years and on one-time expenditures, like the Bond Bill. This week and next, I’ll give updates on the status of bills so far this session that have an impact to Chamber members: SB61 is a Chamber-supported bill that would create a Transportation Infrastructure Investment Fund (TIIF). It passed the Senate and now heads to the House for committee assignment. The bill creates a fund to help offset the cost of providing transportation-related improvements for commercial and industrial development projects, which will also help speed the process to project completion. SB65, the FAST bill, heads to the Senate for a vote. The bill provides up to $9K to Delaware high school graduates to obtain a non-degree certification. The Delaware Workforce Development Board will create an approved list of certifications, and the Chamber supports the bill. SS1 to SB 48, a bill to require apprentice and craft training on prevailing wage jobs, was released from the House Labor committee, and is ready to be voted on in the House. The Chamber opposes the bill as drafted and is working to amend it prior to the vote in the House. HB15 is a bill the Chamber opposes and would create two new top tax brackets: 7.1% for earners making $125K and over, and 7.85% for earners making $250K and over. SS2 for SB50 directs money from the bond bill to be issued to DelTech, along with bonding authority, to help address the college’s deferred maintenance issues reported on before. The bill’s main difference from the original SB50 is the removal of the statewide property tax provision as a revenue source. The bill is ready to be signed by the Governor. SS1 for SB25 was passed and the age to purchase tobacco is now 21 in Delaware. by James DeChene

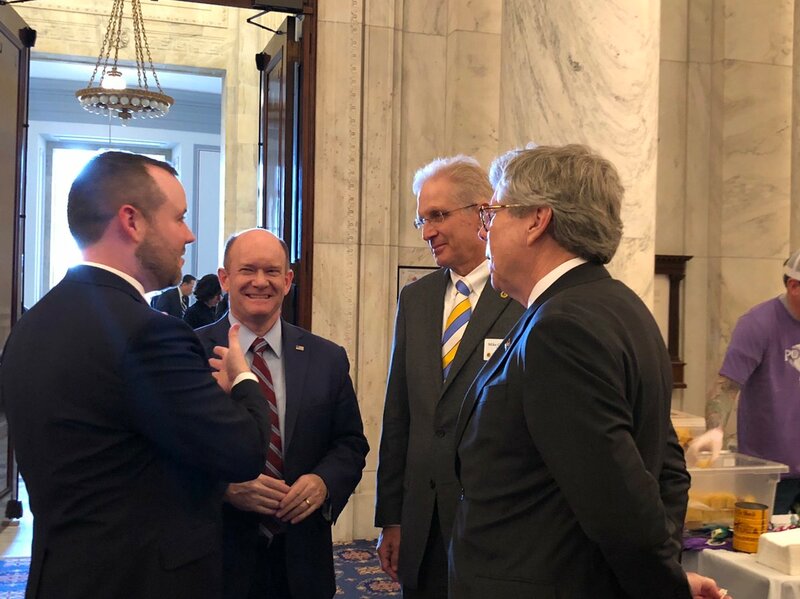

The General Assembly came back to a busy week where a number of bills related to the business community saw action: A bill to require apprentice and craft training on prevailing wage jobs was released from the House Labor committee, and is ready to be voted on, perhaps as early as next week. The Chamber testified against the bill, mainly because of technical issues related to the legislation, and the potential for contractors to be locked out of bidding and performing state work. The Chamber spoke in favor of a bill creating a Transportation Infrastructure Investment Fund (TIFF), a measure supported by the Administration, DelDot, and other industry groups. Two bills related to raising the personal income tax were heard in committee, and one was released. HB 15 adds two new top tax brackets—7.1% at $125,000, and 7.85% at $250,000. The Chamber opposed both bills in committee. The bill raising the minimum age to purchase tobacco products to 21 passed the House and now goes to the Governor for signature, as did a bill providing bonding authority to DelTech to assist in addressing their deferred maintenance needs. The General Assembly meets next week, prior to a two week Easter Break. by James DeChene This week was the 8th Annual Taste of Delaware event, which the State Chamber held in partnership with honorary host, Senator Chris Coons. Postponed from December, the event this year coincided with spring in the nation’s capital, including cherry blossoms, sunny skies and an unfortunate last inning win by the Nationals. We saw 600 plus attendees who filtered in and out of the historic Kennedy Caucus Room, which featured scenes such as the Watergate hearings and nomination hearings of Supreme Court Justice Clarence Thomas. Over 20 vendors, including some of Delaware’s iconic establishments, the Starboard, Home Grown Café, SoDel Concepts, the DelTech and DelCastle culinary programs and more, served up tasty treats. These vendors showcased, from north to south what Delaware has to offer. Many thanks to our friends in Delaware who made the trip down, to the ex-pats who may have left the First State but are always happy to visit, and for the new friends we made across Capitol Hill. See you again this December. In other news, the General Assembly returns next week. Of note are two personal income tax bills to be heard in the House Finance Committee (DSCC opposes both), a bill mandating apprentices on certain public works projects to be heard in the House Labor Committee (DSCC opposes as written), and a bill creating an infrastructure investment fund at DelDOT supporting economic development to be heard in the Senate Transportation Committee (DSCC supports). Pictures from the Taste of Delaware:by James DeChene

The General Assembly was back in session this week, returning from the Joint Finance Committee. This week in Dover, we saw two bills related to taxes tabled in committee. The first proposed a reduction to the realty transfer tax by 1% and the second would have allowed for itemized deductions in Delaware. Both are on hold for now. Also a bill on the National Popular Vote passed in the Senate. The bill is now headed to the House, and if passed there, it would enter Delaware into an interstate compact that would change how Delaware would award its Electoral College delegates. A new federal court ruling could require companies over 100 to report pay by gender starting as soon as May 31, 2019. For more info on the issue and the ruling, click here. by James DeChene

This year’s “Rich States, Poor States” was released this week, and Delaware checks in at 28th for economic performance, and 36th for economic outlook. Performance is calculated by considering state GDP, non-ag employment numbers and domestic migration. No surprise that we come in high (19th) in migration as we are a retirement destination state due to low property taxes and great beaches. For economic outlook, there are 15 areas considered, some in which we score well—no sales tax, low property tax; and some not so well—marginal tax rates on both individual and corporate payers, and average workers compensation costs. These numbers are right around where we were last year: 37th in 2017 and 44th in 2016, but 27th in 2014. In the broader picture, an interesting take away was how net migration will impact congressional seats in the 2020 census. According to Election Data Services, the following states are poised to gain seats: · Texas will gain three, from 36 to 39; · Florida will gain two, from 27 to 29; · Arizona will gain one, from nine to 10; · Colorado will gain one, from seven to eight; · Montana will gain one, from at-large to two; · North Carolina will gain one, from 13 to 14; and · Oregon will gain one, from five to six. These states are poised to lose seats: · New York will lose two, from 27 to 25; · Alabama will lose one, from seven to six; · California will lose one or remain even, from 53 to 52 or no change; · Michigan will lose one, from 14 to 13; · Minnesota will lose one or remain even, from eight to seven or no change; · Ohio will lose one, from 16 to 15; · Pennsylvania will lose one, from 18 to 17; · Rhode Island will lose one, from two to one; and · West Virginia will lose one, from three to two. The “Rich States, Poor States” report lays out these numbers as well, and ties in states' overall tax policy approaches to help explain the migration. If the trend continues, high tax states will continue to lose congressional seats. It will be interesting to see how that changes the makeup on Congress, and their approach to tax policy. |

Archives

July 2024

Categories

All

|

|

Copyright Delaware State Chamber of Commerce, Inc.

All Rights Reserved. PO Box 671 | Wilmington DE 19899 (302) 655-7221 | [email protected] | sitemap |

|

RSS Feed

RSS Feed