|

by James DeChene

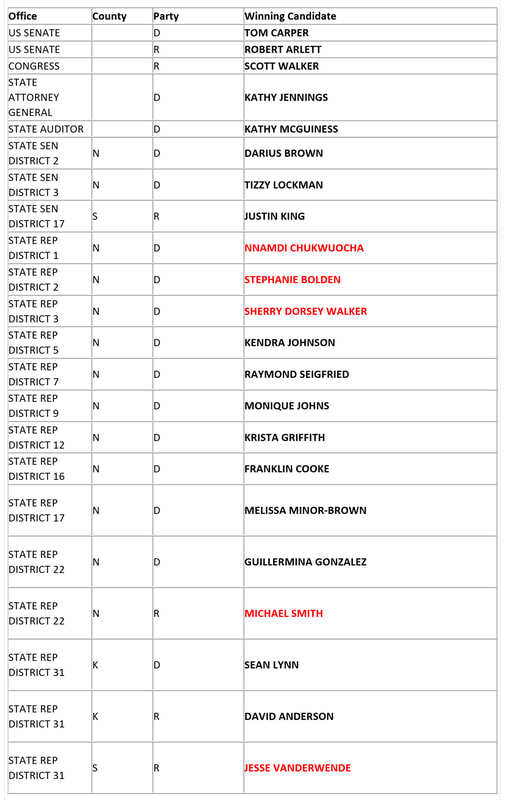

Congratulations to last night’s primary election winners as they now will go on to face their general election opponents (unless they were one of the few who have no general election candidate, and have therefore will be in office in January 2019).

0 Comments

For the past three years, we’ve been following the appeal of the Delaware and Maryland PSCs to the Federal Energy Regulatory Commission to grant a rehearing of how a regional power authority (PJM) calculated the cost allocation to cover the building of a transmission power line across from NJ to the Delmarva Peninsula.

On July 19, FERC announced it would grant the rehearing. In the announcement they note: "…we grant rehearing. Specifically, we find that it is unjust and unreasonable to apply PJM’s solution-based DFAX cost allocation method to Regional Facilities, Necessary Lower Voltage Facilities, and Lower Voltage Facilities that address stability-related reliability issues, including the Artificial Island Project. To determine the just and reasonable rate to be applied, we are establishing paper hearing procedures." This is good news for Delaware and Maryland rate payers. To recap, previously PJM allocated over 90% of the project cost to be paid for by Delmarva zone ratepayers, driving the cost of power for those receiving less than 10% of the benefit of the line’s use. The estimated project costs are $279 million according to the latest PJM projection, meaning Delmarva Zone customers will be expected to bear responsibility for $250 million. The economic impact to large industrial users would be immense, and for both large and smaller users, concerns over closures and job losses remain. The Chamber will continue to monitor this issue, and weigh in as appropriate. by James DeChene

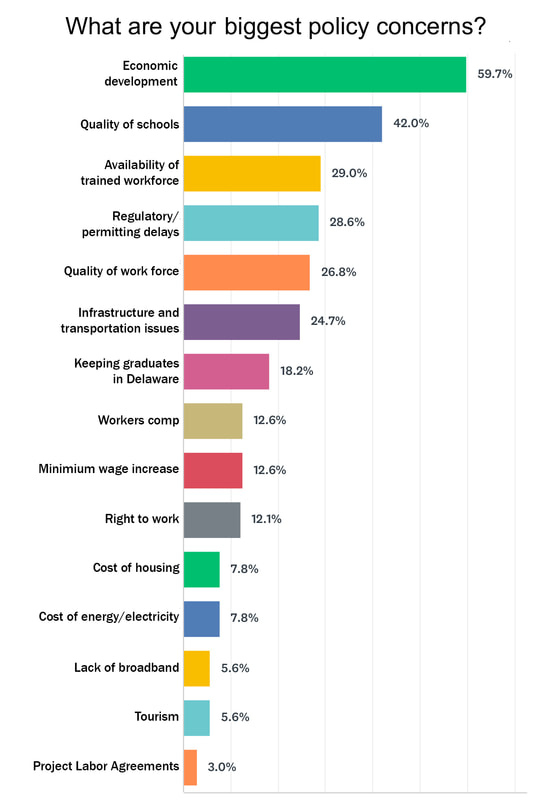

The Delaware House of Representatives held a late night, with a 3:30 a.m. vote to increase Delaware’s minimum wage by $.50 twice next year, in January and October 2019. House Republicans were able to negotiate the passage of a bill that would create two lower-wage groups—a training wage, and a teen wage, to be paid at most $.50 under the minimum wage once the bill goes into effect on January 1, 2019. The Delaware State Chamber, along with other business groups, were on hand throughout the last night of session to provide input and feedback on how this legislation was being crafted and handled. Each year legislation has been introduced to raise the minimum wage, which was last raised in 2015. Each year the legislation is sent to the Senate Labor Committee (as it generally originates in the Senate), where it passes, and goes to the full Senate for a vote. This year, the first minimum wage bill, SB110, followed that process. At a hearing lasting two hours and full of testimony from nonprofits, the agriculture community, and members of chambers from around the state, all offered testimony on the negative impact increasing the minimum wage would have on their businesses and their employees. Ultimately SB110 would fail in the Senate when it came up for a floor vote. Fast forward to later in the year when SB170 was introduced, another bill by the same sponsor, Sen. Marshall, that would raise the minimum wage. The bill was heard, and released, from the Senate Labor Committee. On July 30, SB170 passed the Senate as part of a negotiated deal to provide relief for Delaware casinos, and headed over to the House and was assigned to the House Economic Development Committee. In years past (at least since 2014), when a minimum wage bill passed the Senate, and headed to the House, the bill was heard, and failed in committee. The same process of having impacted businesses, nonprofits and farms share their stories followed, and ultimately, members of that committee would vote to defeat the bill. Last night, in a dramatic departure from the usual process, members of the House voted to bring SB170 to the floor for action under a suspension of the rules, a process normally reserved for non-controversial bills. As evidenced this year, with other legislation in the Senate, departure from that process seems to be increasing in its frequency, a trend we hope does not become the norm. What is most disturbing about what happened on July 1, is that members of the general public, both opponents and supporters of a minimum wage increase, were unable to have their voices heard. Thankfully, a second bill was negotiated to provide alternative wages for training and for teens, but that shouldn’t have been undertaken in the wee hours of the morning. The Delaware State Chamber, along with the New Castle County Chamber, the Central Delaware Chamber, the Delaware Restaurant Association, the Delaware Food Industry Council, the Delaware Chain Drug Association, the National Federation of Independent Business, and other business groups have all worked together over the years, including this year, to let legislators know the negative impacts of raising the minimum wage, and the numerous studies showing how it negatively impacts the employees they are trying to help. The Chamber remains disappointed in the passage of SB170 and will continue with others in the business community to maintain the message that these types of bills hurt business and they hurt workers. Legislators will continue to be told that businesses will have to decide how to cut additional costs to pay for this added payroll expense. It is imperative that people working full time for minimum wage are encouraged to add to their education and outfit themselves with skills that meet workforce needs in order to improve their personal or family situation. For more information regarding Chamber advocacy efforts, please contact me at jdechene@dscc.com. As part of our Spring 2018 survey, we asked participants to list their top three policy concerns. We posed a similar question in our Fall survey with comparable results. Last survey, 50% of our survey respondents said that the Cost of Health Care was their #2 policy priority. We heard you loud and clear and are addressing this issue by working with partner organizations and stakeholders around the state.

With that question out of the mix in our current survey, members are telling us that Economic Development remains the #1 policy concern. That is followed education/work force development and permitting delays/regulatory issues. by Mark DiMaio

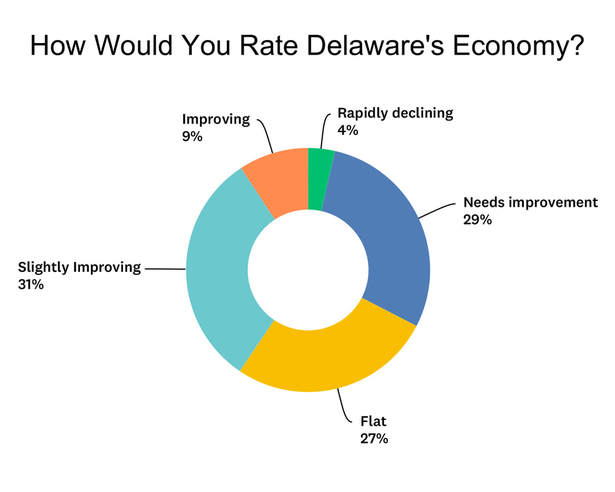

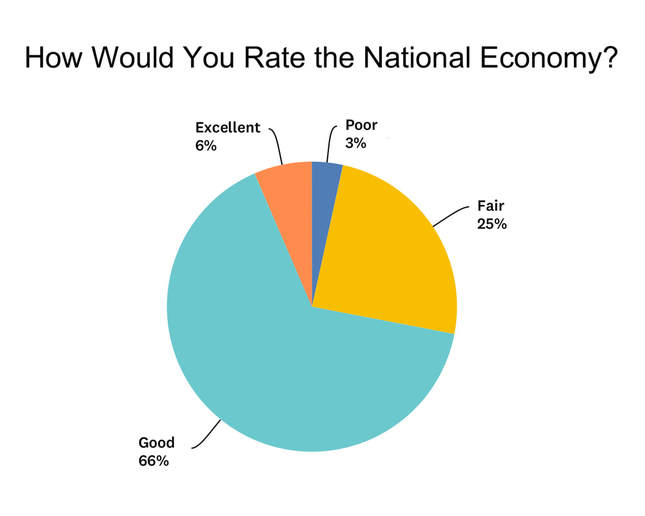

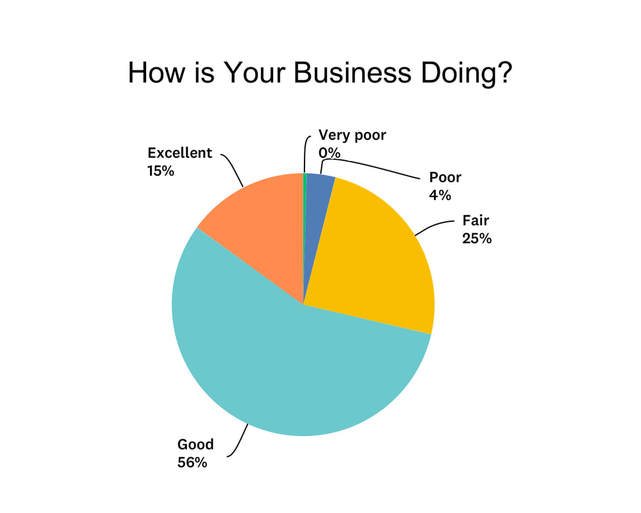

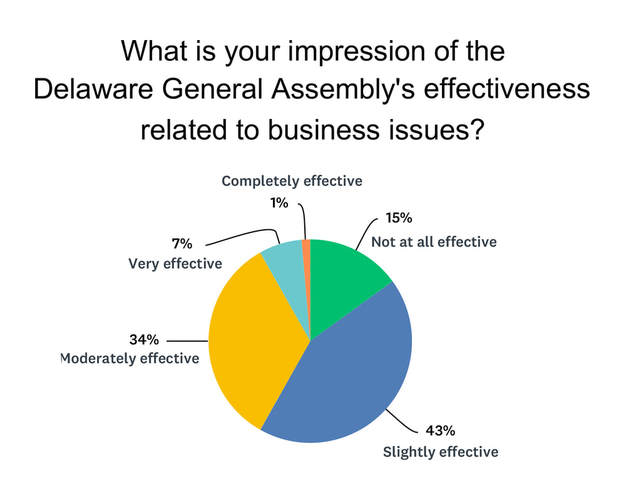

Over 230 State Chamber members took our 10-question survey on Delaware’s economic health and key policy issues. The survey is an important tool in taking the pulse of our membership’s view of the national and local economy as well as level setting their policy priorities. by Mark DiMaio

Last year we asked Chamber members to participate in a survey for input about obstacles to their business growth. We received nearly 100 individual responses to our question about specific suggestions on what Delaware should do to improve its economy. Listed below are four areas that respondents mentioned most often, along with ways the Chamber is working to advance Delaware’s economic health. Improve schools and infrastructure

Balance the state budget with new revenue sources and cut government spending

Encourage entrepreneurship and a diverse economy - strong business climate to attract new business

Streamline land use and permitting process – less regulation overall

By Mark DiMaio

In 2017, we invited Chamber members to participate in a survey in part to gauge their view of obstacles to their business growth. Listed below are the top five, along with ways the Chamber is addressing them. 1. Cost of Employee Health Care The Chamber recognizes the growing problem surrounding health care costs.

2. Lack of Qualified Applicants We are actively engaged, along with many of our members, with the Pathways to Prosperity program. Delaware Pathways programs are a set of curriculum focused on a specific industry-based “pathway,” paired with opportunities to gain workplace experience while still in high school, graduate with a head start on a college degree, or gain qualifications needed to go to work immediately. The program is a unique collaboration of school districts, businesses, higher education, and national advisory partners that represent a new way to do school. The Delaware Manufacturing Association (a Chamber affiliate) members have actively participated in the Manufacturing Engineering Technology and Manufacturing Production & Logistics pathways. Delaware Pathways will host its 4th Annual Conference on March 21. 3. Concerns with Crime & Safety The Chamber supports the efforts of elected officials and their staffs to reduce crime in Wilmington and across the state.

4. Concerns About Local Schools Improving education outcomes is a key factor in developing a skilled workforce and attracting new business to Delaware.

5. Cost of Permitting and Regulation Compliance

by Mark DiMaio

In 2017, we invited Chamber members to participate in a survey to gauge their view of Delaware's economic health, and provide input on policy priorities. Listed below are the top four, along with ways the Chamber is addressing them. 1. Economic Development The Chamber is dedicated to promoting an economic climate that strengthens the competitiveness of Delaware businesses and benefits citizens of the state.

2. Cost of Health Care The Chamber recognizes the growing problem surrounding health care costs.

3. Government Spending We will continue to advocate for structural changes to Delaware’s budget. Delaware needs fiscal policies that foster business growth and advance the state’s long-term economic future.

4. Education Reform (K-12) Improving education outcomes is a key factor in developing a skilled workforce and attracting new business to Delaware.

by James DeChene

This week saw the confirmation of former DEDO director Cerron Cade to fill the vacant Secretary of Labor position. The Chamber looks forward to working with Secretary Cade in this new position on issues important to the business community. Also this week, HB106 was released from committee, which would add two additional personal income tax brackets at $125,000, with a rate of 7.10%, and an additional bracket of $250,000, with a rate of 7.85%. The State Chamber spoke against the bill, noting that it would add volatility to Delaware’s revenue collection at a time when efforts are being made to make Delaware less reliant on volatile sources of revenue. This reliance has an increasing deleterious impact on the State’s long-term sustainability. Governor Carney released his recommended budget, an increase of 3.49% over last year, which calls for increased spending on education, public safety and making investments in economic development and workforce development. It also includes an increase in the bond bill, along with $100 million in cash as one-time money for projects. Door openers, including class room growth, employee pensions, child care and transportation, were about $60 million in increases. It also includes: $12.5 MM — strategic fund $2 MM — Prosperity Partnership $9.6 MM — research collaboration $19.5 MM — high education capital construction $391.1 MM -- DELDOT road systems $6 MM — clean water/drinking water The Chamber will be monitoring ongoing budget discussions and will update you with pertinent info. The General Assembly returns next Tuesday with a full plate. Work will commence stemming from taskforces that met over the summer and fall, which include school district redistricting and changes in funding models, and the legalization of recreational marijuana. Thrown into the mix will be legislation to raise money to invest in clean water infrastructure, incentivize angel investors to provide capital to small startups in Delaware, and the fight on minimum wage legislation will no doubt continue. These bills, and ones to come, will be the focus of the Chamber this legislative session, along with continuing to implement legislation passed last year—namely the Delaware Prosperity Partnership and the regulations surrounding modernizing the Coastal Zone Act.

In addition, the Chamber will be involved in ongoing budget discussions as the Administration and General Assembly continue to search for ways to address Delaware’s long term economic growth and sustainability. What will be interesting to see this year, is how the Federal tax plan will impact Delaware. Much of what was contained at the Federal level was proposed at the end of last year’s session to help fill a $350 million budget gap, including increasing the standard deduction, reducing itemized deductions, and modifying personal income tax bracket levels. If the projections the state Department of Finance provided last year hold true, that could mean big money for Delaware coffers, and reduce the chances for last minute budget battles this year. All this, and more, to come. Stay tuned. |

Archives

April 2024

Categories

All

|

|

Copyright Delaware State Chamber of Commerce, Inc. All Rights Reserved.

PO Box 671 | Wilmington DE 19899 Phone: (302) 655-7221 | dscc@dscc.com | sitemap |

|

RSS Feed

RSS Feed